Most of you are probably aware you have life insurance through the Post Office. We feel it is important to understand every aspect of your FEGLI coverage and in this article we will cover everything you need to know.

If you have additional questions beyond this article please contact us, we will be happy to help. Now let’s get started!

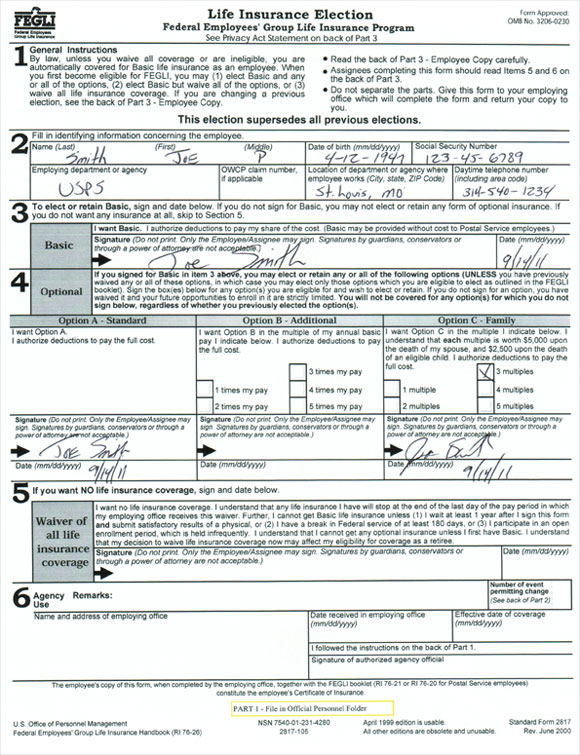

Basic Life Insurance

Every career employee has Basic Life because the Postal Service gives it to you for free. They calculate this as your base pay, rounded up, and then they add $2,000. This amount goes up with raises you receive.

Living Benefits Act

Hopefully you never have to use this but if you do it will be very helpful. If you are diagnosed with a terminal illness and you have 9 months to live you can access your Basic Life coverage while you are still living. It’s basically an accelerated payment on your life insurance.

Option A

Option A is a flat $10,000 policy.

Option C (Family Coverage)

This is coverage on your spouse and dependent children. Family coverage is issued in units. Each unit is worth $5,000 on your spouse and $2,500 on each dependent child. If you have 5 units you would have $25,000 coverage on your spouse and $12,500 on each dependent child.

Option B

This is the optional coverage that everyone needs to understand. This option allows the employee to take 1-5 times their base pay as additional life insurance. Our experience has been that over half of all Postal employees have 5x their base pay. Most employees “load up” on the benefits when they’re hired assuming everything is great without really understanding the details. This is where people get in trouble.

The best way to help you understand what you need to know about your Option B coverage is to show you an example. Let’s assume Suzy Postal employee has a base pay of $50,000. She elects 5x her base and that gives her $250,000 of coverage under Option B. Let’s look at what she will pay for this coverage starting at age 40:

*All figures are per pay period

- Age 40 – $15

- Age 45 – $22.50

- Age 50 – $35.00

- Age 55 – $70.00

- Age 60 – $150.00

- Age 65 – $177.50

It’ s pretty easy to see the trend. . Every time you get 5 years older the price goes up. The more likely you are to use the coverage, the more expensive it gets.

As a general rule if you are healthy you need to get rid of this coverage as soon as you can and replace it with normal coverage you can get in the private sector. By normal I mean coverage that does not increase in cost. The sooner you do this the lower rates you will see on your new policy. On the flip side if you have serious health issues or if you smoke, you are in most cases better off keeping this coverage as long as you can afford it because private companies will not be any cheaper.

If you’re like most employees you aren’t sure what coverage you have because you haven’t looked at it since you got hired. For those of you who need a little help we have created a website specifically for this purpose. All you need to do is visit www.replacefegli.com. There’s a copy of a real postal paycheck stub to show you where to find the code that indicates what coverage you have. You input your code and your information on the form and send it to us. We take that information and reply back to you with what coverage you have as well as the costs both today and later in your career. Information is power and the more you know the better decisions you can make for you and your family.

We encourage you to copy and post this article in your swing room or break rooms. Almost none of your peers understand these details and you will be doing them a huge favor exposing them to this valuable information.

Everyone knows today’s Post Office is very different from what it was just 10 years ago. The day you lost your local HR representative was the day thousands of Postal employees lost. Postal Benefits Group’s mission is to fill the gap that was created and bring you the information you need and deserve.